So… Why is Real Estate is the I.D.E.A.L. Investment?

The first thing I’d like to discuss with you before we even get into the techniques of real estate investing is why should you even bother with real estate. What is it that makes this such a great way to become wealthy? Real estate has been called the IDEAL investment because what it produces spells the word…IDEAL.

Investment real estate gives you: Income, Depreciation, Equity, Appreciation and Leverage.

“I” is for INCOME

“I” is for INCOME

Real estate entrepreneurs enjoy income in the form of cash flow created by rents, lease payments, option fees, pet rent (yes, rent for Rover), extra-resident rent (Uncle Joe), and even mortgage payments when we provide seller financing. In addition to recurring income streams we also enjoy income in lump sums; some large, some small. These include sale proceeds, option fees, down payments, and balloon payments.

Real estate generates two types of income and each is taxed differently. Ordinary income is income generated from flips, quick turn rehabs, and any property not held for investment longer than 12 months. Rental properties generate passive income which is exempt from self employment tax (currently 15.3%).

The key to passive income is the intent to rent the property and the holding period exceeding 12 months. Talk with your CPA to understand the tax implications of your transactions…it can make a massive difference to your financial future.

When selling properties, I like to use the lease option or lease purchase technique because I’m blending the sale of some rights. One is the right to purchase the property at an agreed price at a future date using an option. The other is a rental agreement which generates passive rental income.

“D” is for DEPRECIATION

This benefit is unique to anything in the finance world because depreciation is a deductible expense created by investment property. Depreciation allows you to deduct an amount equal to 1/27.5th per year against the income produced by the property. However, if the deduction exceeds the income, the depreciation may be taken against other income or carried forward.

To fully understand this benefit I strongly encourage you to consult your tax adviser. I assure you it will be worth the conversation!

There are many strategies and techniques involving entity structuring that will help you to maximize the tax benefits afforded entrepreneurs who own a business and do not act as a sole proprietor.

“E” is for EQUITY

Equity is that amount of a property that is not pledged as collateral for a debt. The simple way to look at it is if you have a property valued at $150,000 and it has a $100,000 mortgage on it, then you have $50,000 in equity that could potentially be used as collateral for additional financing.

One important thing to note is that many sellers confuse equity with the amount of money they’ll walk away with after a sale. (They seldom consider things like closings costs, commissions, and other seller concessions.) We’ll discuss this in another post.

“A” is for APPRECIATION

I just love appreciation; where else can you make money while you sleep? When things go up in value without any effort on my part that is a good deal! Real estate is cyclical. So, remember friends; it will not go up in a straight line, but over time it always does go up.

Even though the current market is flat in some areas and receding in others we know that over time our real estate will increase in value .However this is not why we buy real estate.

To good investors, appreciation is just a bonus because we make our money when we buy either with great terms or because we buy at below market process. We cannot always predict when or by how much a property will appreciate, so if we buy right, but timing doesn’t allow for appreciation… we still make a profit.

If, however, we do benefit from appreciation, we still make our profit and we get a bonus too! People who buy looking for appreciation are not really investors, they are speculators…they are the dot.com bubble people of real estate.

“L” is for LEVERAGE

If I’m a new investor just starting out and I go to my stock broker and tell him I want 1000 shares of a $100 stock he’s going to ask me for $100,000. If I don’t have the $100,000, I’m done and there’s no deal.

But let’s say I have a big account of say $500,000. He may let me margin the securities, which means he’ll lend me some of my own money (about 50 cents on the dollar) to buy the stock.

In this example, I can buy the stock with only $50,000. So looking at the stock market I can get no leverage if I buy 1000 shares for $100,000, BUT, I can get 2 to 1 leverage using a margin account. I could use $100,000 to buy $200,000 worth of stock.

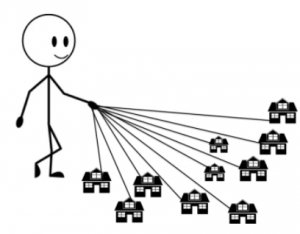

In real estate many lenders will allow me to purchase a property valued at $100,000 with only 10% down. This means that I’d put only $10,000 down and the bank would finance the remaining $90,000.

This would suggest that with $100,000 cash I could control 10 PROPERTIES valued at $1,000,000!

This would suggest that with $100,000 cash I could control 10 PROPERTIES valued at $1,000,000!

THAT’S RIGHT, $1 MILLION DOLLARS!

If each of these investments appreciated 5% in one year who would have the best return on their investment?

Stock Purchase without leverage $ 100,000 x 5% = $5,000

Stock purchase with leverage 2 to 1 $ 200,000 x 5% = $10,000

Real Estate with leverage of 10 to 1 $1,000,000 x 5% = $50,000

The power of leverage with real estate is unmistakable.

Let’s say you played this out for 10 years. The numbers would be staggering. While there are interest expenses and carrying costs, these will be paid by your tenant. Additionally, your equity would increase as they pay down your mortgage.

It gets even better when you learn techniques like buying with “Seller Financing” or by using existing debt and buying the property “Subject To” both techniques which are near and dear to my heart which will be covered in a future post!

So, are you ready to start making I.D.E.A.L. investments?

To Your Success,

Augie