“What do I do…should I do this deal?…HELP!”

Do you ever get into a situation and wonder what to do? You’ve worked hard to find a deal, you’ve got one, but you’re not sure what to do. Has this ever happened to you?

Here is something I received in the “Investor’s Email Bag” recently. Can you see yourself in this guy’s shoes?

Dear What Do I Do Now,

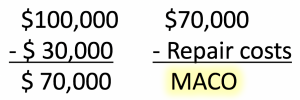

When buying for cash we always talk about MACO (Maximum Allowable Cash Offer), which is the ARV (After Repaired Value) minus 30% (your profit plus other expenses), minus Repairs.

So in this case, the ARV (as per your comps) is $100,000. Deduct $30,000 (your profit plus holding costs) and it equals $70,000 BUT you still need to deduct the repair costs.

If you consider it a junker when you drive by, then it’s a pretty good indication that the inside is a disaster as well. Your renovation costs could be as low as $3,000 (just for paint and carpet), but there is no limit as to what it can cost you depending on how much work is needed.

You’ll need a good general contractor to look at the house and estimate the costs of renovations (someone like my contractor friend Greg charges a $250 for the estimate, but if he ends up doing the work, he’ll deduct the fee from his price).

If you don’t know how to calculate the costs of renovating a junker then $250 is worth it. You don’t want to go in thinking it’s going to cost you $5,000 and it costs you $50,000. Better to be safe than sorry.

Don’t over-renovate. A $100,000 house dipped in gold is still going to sell for $100,000.

The house in your comps for $56,000 may have been a similar situation. An investor may have bought the house, made the repairs, and is either renting it out to a tenant or a lease option buyer. That’s why you may not see a new higher sales price.

Do NOT be a motivated buyer!

How long has this woman been trying to sell her house? If she expects to get $100,000 and is holding out for that, you cannot make her motivated. But if she’s been trying to sell it for 6 months without a nibble, then she may listen to reason. It depends on her motivation. If she’s moving out of state or into a nursing home, or she can’t make her payments, she may take a lot less…and I mean a LOT less.

You could always make her an offer contingent upon an inspection; that is, if the home inspector comes up with thousands of dollars in repairs & maintenance that you didn’t count on, you could always go back and change your offer.

First find out from your friend how motivated she is. You can always go see the woman and give it a try. The worst thing she’ll do is to ask you to do is leave, the best thing would be that you get a deal.

Consider the Cost to Sell Guidelines

Consider the Cost to Sell Guidelines

When you talk to Ms. Homeowner (the seller) and she is shocked at your offer, consider taking her through the Cost To Sell Guidelines. With paper and pencil walk her through the reality of what she will face selling the house retail.

This is in no way an adversarial conversation, but instead one to enlighten her about reality. Here is the equation and an explanation.

Ms. Homeowner’s Asking Price Minus The Costs of The Sale = Her Profit

Cost to Sell Guidelines (Costs of the Sale)

- Retail Buyers Discount of 3 to 10%: This is the price at which the property will close. In this market, every retail buyer is going to put in an offer of at least 3% less than the asking price.

- Closing costs paid by the seller: 2%-3%

- Closing costs paid by the buyer but frequently paid by seller: Because the buyer can’t afford to pay them–3%

- Realtor Commission: Usually 6% but sometimes higher if the seller is desperate and wants to offer an incentive.

- Repairs: Use whatever value or cost the HOMEOWNER estimates. You can confirm this for yourself later (and remember, a retail buyer is going to estimate higher; so if the house needs a new roof, a retail buyer will assume it’s almost twice what it will actually cost).

- Holding costs: On average it will take 4 to 6 months to sell; so multiply 6 times their monthly mortgage payment plus utility bills, insurance, etc. By the way, if the house is vacant, there is a much higher insurance premium. The owner must have a “vacant house policy” or you won’t be protected from vandalism, liability if someone falls, etc. It is twice the price of homeowner occupied insurance.

- Inspection costs: What might a home inspector find that will require repair? Usually $1,000 plus.

These selling expenses should help you negotiate

your offer and increase accepted offers.

If you think it could be a good deal and she appears motivated, but you’re worried about doing the deal, then find a partner who is more experienced. You may not make as much money since you will have to share some of the profit with the partner, but you’ll still make money and get your first deal done.

I think the deal is good IF you buy right! If you buy it low enough, then you’ll be able to sell it to a renovator and you’ll both make money. If you pay too much, well, then you’ll be holding onto it. Maybe for quite a while.

To your success!

Augie